Navigating the world of taxes can often feel like a labyrinth, especially when it involves real estate transactions. One critical form that often surfaces in these scenarios is the IRS Form 1099-S. This form, although seemingly straightforward, carries with it nuances and details that are essential for accurate tax reporting. In this article, we delve into what Form 1099-S is, its importance, and how to fill it out correctly. Whether you’re a first-time home seller, a seasoned real estate investor, or just curious about the process, this guide will provide you with the clarity and confidence needed to handle your real estate transaction taxes effectively.

What Is a 1099-S Form?

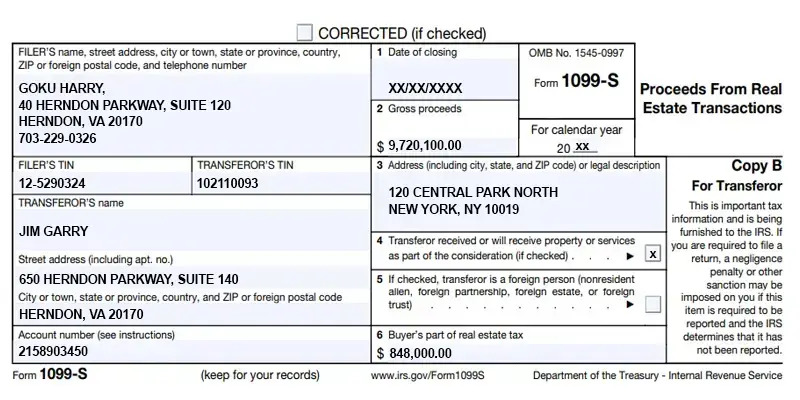

The 1099-S Form is more than just a tax document; it’s a critical tool used by the IRS to track proceeds from real estate transactions. This form is applicable in a variety of scenarios, ranging from the sale of a primary residence to the transfer of investment properties. Understanding its role and implications is crucial for anyone involved in real estate dealings. The form ensures that all capital gains from real estate transactions are reported accurately, helping both the IRS and taxpayers maintain transparency and compliance.

What Information Is Required to Fill Out Form 1099-S?

Filling out Form 1099-S requires a comprehensive set of information. This includes not only basic details like the names and addresses of the parties involved but also more specific data.

Filer’s Information:

- Filer’s name

- Filer’s address

- Filer’s phone number

- Filer’s tax identification number (TIN) or social security number (SSN)

Transferor’s Information:

- Transferor’s name

- Transferor’s address

- Transferor’s phone number

- Transferor’s tax identification number (TIN) or social security number (SSN)

Property Details:

- Address of the property involved in the transaction

- Date of the closing of the transaction

Financial Information:

- Gross proceeds from the sale or exchange of the property

Additional Details:

- Indication if the transferor received property or services as part of the sale

- Status of the transferor (e.g., if they are a foreign person, partnership, estate, or trust)

- Amount the buyer paid in real estate taxes, if applicable

IRS Form 1099-S Instructions

The method of filing Form 1099-S varies based on your role in the property transaction, whether as a purchaser or a seller.

Filing Form 1099-S as a Buyer

As a property buyer, you have several options for managing Form 1099-S. One approach is to incorporate a “designation clause” in your purchase contract. This clause assigns the responsibility of IRS reporting for the sale to the seller. Alternatively, you can request the seller to fill out IRS Form W-9 as part of the transaction’s closing documents. The completed W-9 form provides the necessary details to file Form 1099-S accurately.

In situations where obtaining a designation clause or the W-9 form is challenging, you can draft a “letter of instruction.” This letter should accompany all relevant forms that the seller needs to complete on your behalf. Engaging a tax expert can be beneficial in navigating this process.

Filing Form 1099-S as a Seller

As a seller, the responsibility to file Form 1099-S lies with you, as you possess all the required information. Ensure that you fill out every section of the form thoroughly. Additionally, complete Form 1096. In cases where you are selling multiple properties, each property requires its own Form 1099-S. However, only a single Form 1096 is needed, where you will consolidate the total amounts from each individual 1099-S form.

It’s important for both buyers and sellers to familiarize themselves with the IRS Form 1099-S guidelines before initiating the filing process.

When Is the Deadline to File 1099-S Form?

The submission deadline for Form 1099-S to the IRS is set for April 1, 2024. Alongside this, it’s mandatory to furnish a copy of the form to the transferors. The due date for distributing these recipient copies of Form 1099-S falls on February 15, 2024.

Get Your Taxes Filed with Ease!

At TaxHelpUSA, we understand that dealing with taxes, especially those related to real estate, can be overwhelming. That’s where our expertise comes in. Our team of seasoned tax professionals is equipped to handle every aspect of your Form 1099-S filing. From gathering the necessary information to ensuring that your form is filed accurately and on time, we’re here to simplify the process for you. With TaxHelpUSA, you can rest assured that your real estate transaction taxes are in capable hands, leaving you free to focus on what matters most to you.